If you're an avid cyclist, you understand the joy and freedom that comes from exploring the world on two wheels. Whether you ride for leisure, commute daily, or participate in competitive cycling, your bike is a valuable asset that deserves protection. That's where bike insurance comes into play. In this comprehensive guide, we'll delve into the benefits of bike insurance, helping you understand why it's a wise investment for cyclists of all levels.

Understanding Bike Insurance

Before we dive into the advantages of bike insurance, let's establish what it is. Bike insurance, also known as bicycle insurance, is a specialized insurance policy designed to cover the financial costs associated with bike-related incidents and accidents. Just like auto insurance for cars, bike insurance provides protection for cyclists and their bicycles.

The Benefits of Bike Insurance

Investing in bike insurance offers a range of benefits that can provide peace of mind and financial security for cyclists. Here are some key advantages:

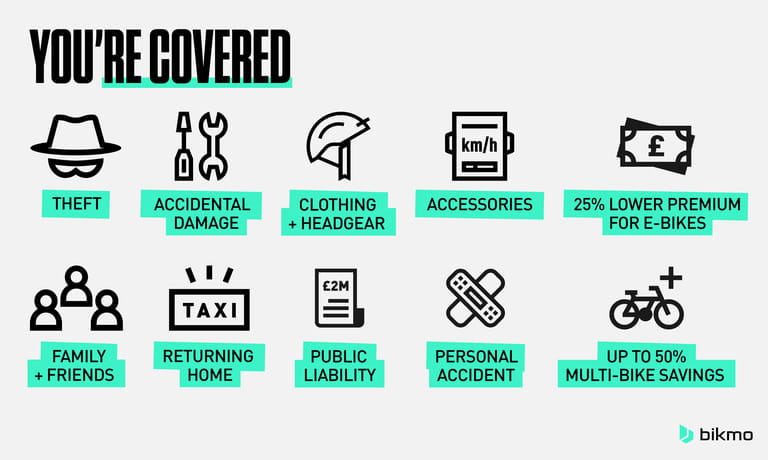

1. Theft Protection:

One of the most significant benefits of bike insurance is protection against theft. Bikes are a prime target for thieves, and having your beloved bicycle stolen can be both emotionally and financially distressing. Bike insurance typically covers the cost of replacing your bike if it's stolen, ensuring you don't have to bear the financial burden of replacing your prized possession.

2. Accident Coverage:

Accidents can happen to even the most cautious cyclists. Whether you're involved in a collision with a vehicle, another cyclist, or simply take a spill on the road, bike insurance can cover the costs of medical expenses and bike repairs or replacement. This coverage is especially valuable for riders who engage in competitive cycling or commute in busy urban areas.

3. Damage Protection:

Bike insurance extends beyond theft and accidents. It also covers damage to your bicycle due to various factors, including vandalism, extreme weather conditions, and even natural disasters. If your bike sustains damage that requires repairs or replacement, your insurance policy can help cover those costs.

4. Third-Party Liability:

In some cases, cyclists may be involved in accidents that cause injury or property damage to others. Bike insurance often includes third-party liability coverage, which can protect you from legal and financial consequences if you're found responsible for causing harm to others while riding.

5. Coverage for Accessories:

Many cyclists invest in accessories such as high-end locks, lights, and GPS devices. Bike insurance can cover the theft or damage of these accessories, ensuring you don't have to bear the cost of replacing them if they are stolen or damaged.

6. Worldwide Coverage:

Some bike insurance policies offer worldwide coverage, which means your bike is protected not only in your home country but also during international cycling adventures. This is particularly beneficial for cyclists who travel with their bikes for races or vacations.

7. Peace of Mind:

Knowing that your bike is insured provides a level of peace of mind that allows you to fully enjoy your rides. You can ride with confidence, knowing that you have financial protection in case of unexpected incidents.

8. Flexible Coverage Options:

Bike insurance policies are often flexible, allowing you to tailor your coverage to your specific needs and budget. You can choose the level of coverage that suits your cycling activities and the value of your bike.

9. No Claims Bonus:

Similar to auto insurance, some bike insurance policies offer a no-claims bonus. If you don't make any claims during a specific period, you can earn discounts on your premiums, ultimately saving you money.

Who Needs Bike Insurance?

Bike insurance is a valuable investment for a wide range of cyclists, including:

Commuters: If you rely on your bike for daily commuting, bike insurance can protect you from the financial impact of accidents or theft, ensuring you have a reliable means of transportation.

Cyclists with High-Value Bikes: If you own an expensive or high-end bike, the cost of replacement can be substantial. Bike insurance is particularly important for those with bikes of significant value.

Competitive Cyclists: Racers and competitive cyclists often invest heavily in their equipment. Bike insurance ensures that their bikes are protected in the event of accidents or damage during races.

Frequent Travelers: Cyclists who frequently travel with their bikes, whether for races or leisure, benefit from the worldwide coverage provided by some insurance policies.

Choosing the Right Bike Insurance

When selecting a bike insurance policy, consider the following factors:

Coverage Limits: Ensure that the policy offers sufficient coverage for the value of your bike and your specific needs.

Premium Costs: Compare premiums from different insurance providers to find a policy that fits your budget.

Deductibles: Understand the deductible amount you'll be responsible for in the event of a claim.

Claims Process: Familiarize yourself with the claims process to ensure it's straightforward and efficient.

Policy Exclusions: Be aware of any exclusions or limitations in the policy, such as specific conditions or regions where coverage may not apply.

Customer Reviews: Research the reputation of the insurance provider and read customer reviews to gauge their reliability and customer service.

Conclusion

Bike insurance is a valuable tool for safeguarding your cycling investment and ensuring peace of mind as you pursue your passion on two wheels. Whether you're a daily commuter, a competitive racer, or a recreational cyclist, the benefits of bike insurance extend far beyond financial protection. It's an investment in your cycling future, allowing you to ride with confidence, knowing that you're covered in case the unexpected happens. So, gear up, hit the road, and enjoy your cycling adventures, knowing that your bike is protected by a reliable insurance policy.